Following the total write-down of Credit Suisse’s AT1 bonds, both regulation and volatility are likely to increase in the high-yield sector. This is the assumption of Sandro Näf of Capital Four. Nevertheless, he is cautiously optimistic about the coming months.

The European high-yield, leveraged loan and private debt market has grown by an average of 12.9% per year since 2001. With the total write-off of Credit Suisse’s AT1 bonds, nervousness in the market has increased. While EU regulators reiterate that hard equity should be written down before AT1 bonds, the wave of lawsuits from creditors who made a total loss on their Credit Suisse AT1 bonds is still pending. Thus, the exact future of the asset class remains unclear.

But it is quite possible that regulation will increase. That’s the assumption of Sandro Näf, CEO and co-founder of Capital Four and portfolio manager of Nordea’s European High Yield Bond and Flexi-ble Credit strategies, as he explained at a presentation in Zurich. In particular, he expects that the focus on banks’ liquidity and funding mix could increase. Thus, stricter capital requirements are likely to apply in the future, which would reduce banks’ return on equity. Näf also expects higher funding costs, but nevertheless, it could still be exciting to invest in CoCo bonds from well-capitalized, profit-able banks in the future.1

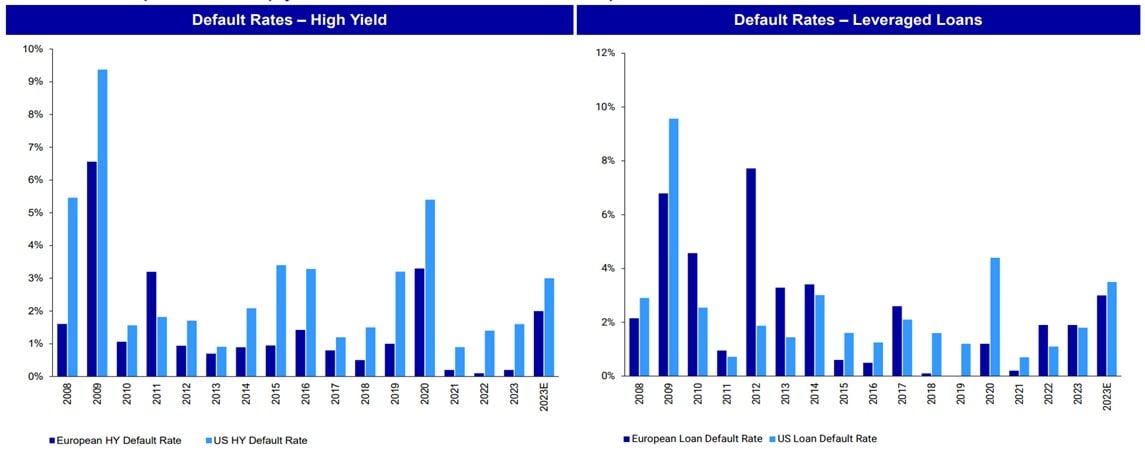

Higher expected default rates in the US

A look at the year to date as well as the past 15 years reveals clear differences between the European and U.S. high-yield markets. While the year-to-date default rate in the USA has already reached a level of around 1.6%, Europe is lagging well behind. However, projections show that default rates will also shoot up on the old continent, although even then they are likely to remain below the level in the USA.

The situation is different for leveraged loans. In this segment, significantly more defaults were already recorded in the European market in 2023. As of the end of April, Europe was even slightly ahead of the USA.

Still relatively good outlook

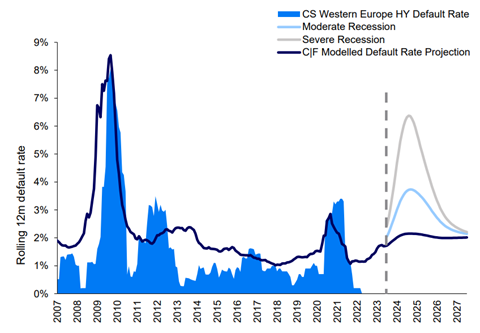

Capital Four’s models forecast a peak default rate of 2.25% to 2.5% for the European high-yield mar-ket in the next 12 to 24 months. However, if, contrary to current assumptions, the recession turns out to be moderate or even severe, default rates could climb to just under 4% or 6.5%. For European leveraged loans, the peak is likely to be 3% to 3.5%.1

Sources: Credit Suisse, JP Morgan, Deutsche Bank, S&P, Moody’s, Capital Four. As of April 30, 2023

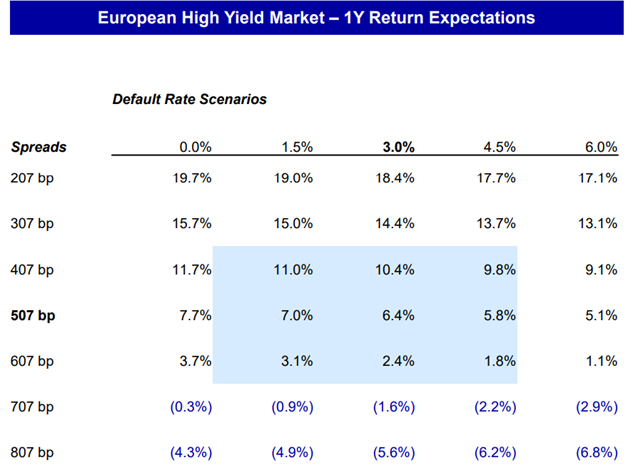

But the outlook for fixed-income investors is not bad, Näf said. In the past, spreads above current levels have typically led to attractive 3-year returns, he said. With an expected default rate of 3% and a spread level of 507 basis points, a return of 6.4% could be achieved over the next 12 months, ac-cording to a sensitivity analysis by Capital Four.1